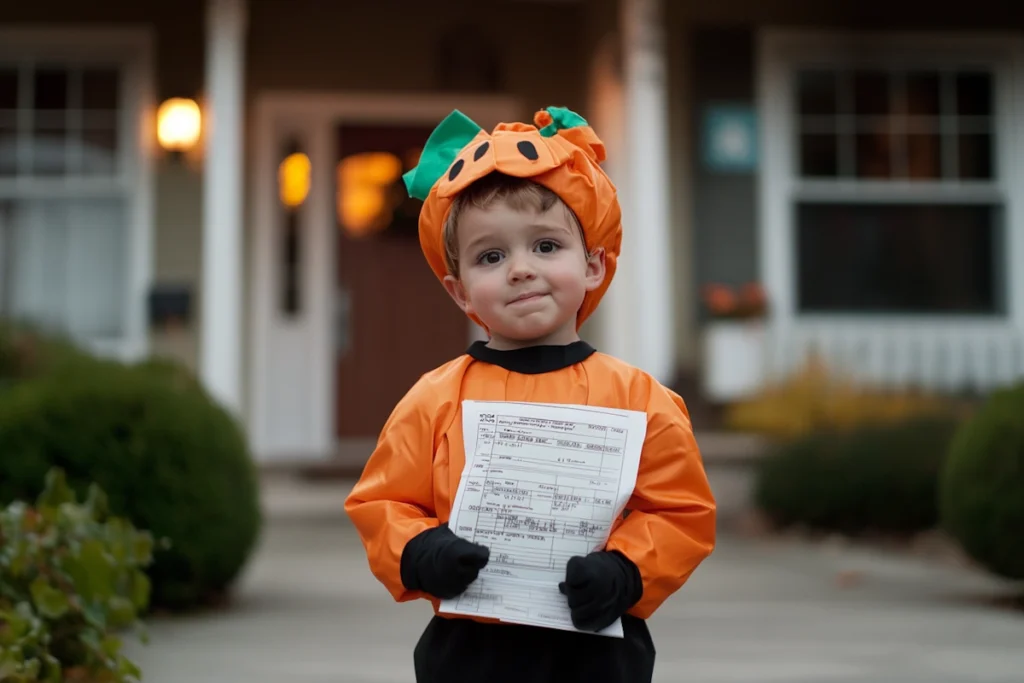

No More Sugar-Coating: Trick-or-Treating Gets a Reality Check

In a bold move hailed as both visionary and baffling, the small town of Economy Springs, Wyoming, has officially replaced candy during Halloween with something its local leaders deem far more valuable: financial advice. Gone are the days when children would happily skip home with sacks full of sugar-laden goodies; instead, they now carry home pocket calculators, interest rate pamphlets, and personal finance books featuring thrilling titles like “Invest Early, Retire Comfortably!” and “The Magic of Compound Interest: A Tale of Two IRAs.”

“Look, the world’s changing fast, and kids need to be prepared,” said Mayor Greta Gainsworth, the mastermind behind this financial overhaul of Halloween. “Gone are the days when you could eat a Snickers and think that everything was fine. The real treat now is learning how to manage a 401(k) and how to budget your allowance. What’s better—temporary sugar highs or lifelong financial stability?”

A Town’s Transformation

Economy Springs, known for its over-the-top holiday spirit, has never been shy about breaking traditions. Two years ago, it was the first town in America to replace fireworks on the Fourth of July with “Safe & Responsible Savings” seminars. And last winter, they swapped out Santa Claus at the mall for a “Realistic Depiction of Retirement” exhibit, complete with a mildly grumpy, sleep-deprived financial advisor. This Halloween change, however, has caused quite the stir—especially among the children.

“It was weird,” said nine-year-old Emma Bonds, pulling out a pamphlet from her treat bag titled ‘Maximizing Your Future Earnings Potential.’ “I knocked on Mrs. Moneywell’s door, expecting a Reese’s or something, and she handed me a brochure on how to avoid credit card debt. I’m like, what’s a credit card? Then she asked me what my risk tolerance was.”

Local parents, many of whom are still nostalgic for their own sugar-infused Halloweens of yesteryear, have been supportive of the change—reluctantly.

“When Mayor Gainsworth first announced it, I thought it was a joke,” said Tim “T-Bill” Thomas, father of two. “But then I thought about it. You know, candy’s great and all, but teaching kids how to read a stock market chart? Now that’s something they can use! It’s tough love, but it’s better than letting them think you can just live off of chocolate and gummy bears.”

Thomas paused before adding, “Though, to be fair, I’ve been living off gummy bears for the last 20 years. But hey, different times, right?”

The “Treats”

The Economy Springs Financial Halloween Initiative (FSFHI) has replaced traditional candies with what they’re calling “Edible Knowledge Nuggets.” These aren’t bite-sized chocolates or lollipops. Instead, they are tiny, fortune cookie-style slips of paper offering financial tips, served alongside bitterly bland fiber biscuits. The biscuits represent, according to local officials, “the flavor of fiscal responsibility.”

Each house has been mandated to distribute at least one of the following to trick-or-treaters:

Financial Fortune Cookies: These contain motivational finance phrases like “Don’t spend what you don’t have!” and “The best time to start investing was yesterday. The second-best time is now.”

Mini Calculators: Handy for calculating future student loan interest rates, though most children seem to think they’re just “really bad Gameboys.”

Bank Statements from 1997: Because, according to the town treasurer, “history is the best teacher.”

Budgeting Books: These tiny, bite-sized books (made of recycled tax forms) offer thrilling chapters like “Why You Should Stop Asking for Toys” and “The Five-Year Allowance Plan.”

Retirement Plan Seeds: Plant these in the ground and wait 50 years! With the right investment, they’ll grow into a decent retirement… metaphorically, of course.

At one house, 12-year-old Logan Parker was handed a pair of adult-sized reading glasses and a chart explaining “the long-term benefits of index funds.” After the homeowner meticulously detailed the difference between stocks and bonds, Logan was heard muttering, “I just wanted a KitKat…”

Trick-or-Treating, New and Improved

The actual act of trick-or-treating has also undergone a revamp in Economy Springs. Instead of the familiar refrain of “Trick or treat!” children are now instructed to approach each door and say, “Diversify or die!”

“Parents need to stop shielding their children from the harsh realities of adulthood,” said Councilwoman Penny Pinsure. “What’s scarier than realizing your portfolio isn’t diversified? If you ask me, that’s true horror.”

At the Fiscalson household, trick-or-treaters didn’t even receive financial advice—they were subjected to a full financial planning session. Ten-year-old Kevin, dressed as a Minecraft character, was sat down at the kitchen table and walked through a mock audit.

“I thought I was going to get a Twix,” Kevin said, dazed after reviewing Mrs. Fiscalson’s filing system for capital gains taxes. “But now I understand depreciation.”

Financially Responsible Costumes: The New Trend

Economy Springs has taken their obsession with financial literacy to the next level by encouraging children to “dress for the job they want.” Gone are the usual ghosts, superheroes, and witches; in their place are pint-sized accountants, investment bankers, and IRS agents.

One particularly innovative costume came from six-year-old Sarah Fiscalson, who turned up as “The Invisible Hand of the Market,” a costume that, while conceptually advanced, was just her in regular clothes claiming to influence every financial decision anyone made. Her little brother, meanwhile, dressed as a 1099 tax form, which caused widespread confusion among his peers.

“I used to dress up as Spider-Man,” said 11-year-old Lucas Ledger, now sporting a briefcase and bowtie, going as “The Stock Market.” “But now I get it—Spider-Man doesn’t have a retirement plan.”

Parents, Confused but Supportive

Many Economy Springs parents initially expressed confusion at the Halloween switch but have gradually come around to the idea. After all, what’s better than turning an innocent holiday into an early lesson on the crushing realities of adulthood?

“It’s great that my kids are learning about compound interest,” said Nina Networth, a mother of three. “But honestly, I’d prefer if they just learned about brushing their teeth first. Every year, I’m still dealing with the candy-induced cavities.”

Her son, Jason, waved a packet of term life insurance information in the air. “This is going to save me SO much in premiums when I’m older,” he said excitedly. “I don’t even mind the oatmeal raisin cookies now.”

Others aren’t as enthusiastic. Kyle “Kool-Aid” Kraemer, a single dad, was dismayed when his daughter came home with a PowerPoint presentation on Roth IRAs.

“I was hoping for M&Ms,” Kraemer admitted, munching on one of the town’s famous fiber biscuits. “But I guess there’s no harm in preparing her for the soul-crushing weight of financial planning. That’s what Halloween’s all about, right?”

Pushback From the Kids

Not all of the town’s youth are thrilled with the changes. A rogue group of pre-teens has started an underground “Candy Exchange” in a back alley behind the Economy Springs Library. There, kids smuggle contraband candy from nearby towns still living in blissful ignorance of fiscal responsibility.

“It’s a black market,” explained 13-year-old Jason DowJones, who runs the operation. “We sneak Snickers and Skittles past the authorities. You won’t believe how many kids are desperate for some sugary goodness after being handed mortgage pamphlets all night.”

Local police, however, have turned a blind eye to the operation. “Honestly, I get it,” said Officer Penny Change. “If I’d been handed a guide to opening a Roth IRA when I was seven, I’d be hitting up the candy black market too.”

The Future of Halloween (and Childhood)

While Economy Springs is the first town to make this drastic shift, Mayor Gainsworth hopes it will spark a nationwide movement. “This isn’t just a trend,” she explained at the town’s annual budget address. “This is what we must do for our children. The days of simple pleasures like candy are over. With the cost of living skyrocketing, we can’t afford to indulge in sugar-coated fantasies anymore.”

And indeed, Economy Springs may be ahead of the curve. According to the mayor, this Halloween initiative is not just about teaching kids how to save money—it’s about preparing them for the grim reality they’ll inherit. With inflation driving up the cost of just about everything, from housing to healthcare to the cost of a decent bag of candy, today’s kids need to understand from a young age that nothing in life is sweet unless it’s backed by a solid financial plan.

“I mean, have you seen the price of a fun-size Snickers lately?” asked Mark Muneemarket, the town’s economic advisor. “When I was a kid, we could get a whole bag for $2. Now, you’re lucky if you can afford a single bar without refinancing your home. At this rate, kids who don’t know how to handle their finances will be drowning in debt by the time they finish trick-or-treating.”

But this is just the beginning. According to town leaders, things are about to get a whole lot worse.

“If you think today’s economy is tough, just wait,” warned Councilwoman Penny Fiduciary. “These kids are going to grow up in a world where rent for a studio apartment will cost more than an Ivy League education, where a gallon of milk will require a short-term loan, and where the only way to retire is to win the lottery—or learn how to flip houses by the time you’re twelve.”

And it’s not just local officials saying this. National economists are predicting that today’s children will face challenges unlike any generation before. Wages stagnate, housing costs soar, and inflation outpaces most people’s ability to keep up. Teaching kids about budgeting and investing now, Mayor Gainsworth insists, isn’t just a smart move—it’s a necessary survival skill.

“At the end of the day,” she said, “handing out candy is a luxury we can no longer afford. We’ve entered a time where learning about interest rates is more important than indulging in KitKats. These kids are going to grow up facing crushing student debt, job markets dominated by AI, and the likelihood that their biggest splurge won’t be a trip to Disneyland but the chance to buy a dozen eggs.”

If Economy Springs has its way, gone are the days when Halloween was about fun and frivolity. The new era is one of pragmatic preparation, where a solid grasp of financial literacy is the only real treat left for today’s youth.

Because in a world where a candy bar costs a small fortune, the scariest thing you can do is fail to plan for your future.